Why BFM?

Our purpose is to help professionals and expatriates worldwide who want to enjoy a COMFORTABLE RETIREMENT at a chosen lifestyle by giving less-conflicted and effective advice, and by optimizing their portfolios in a world of lower returns.

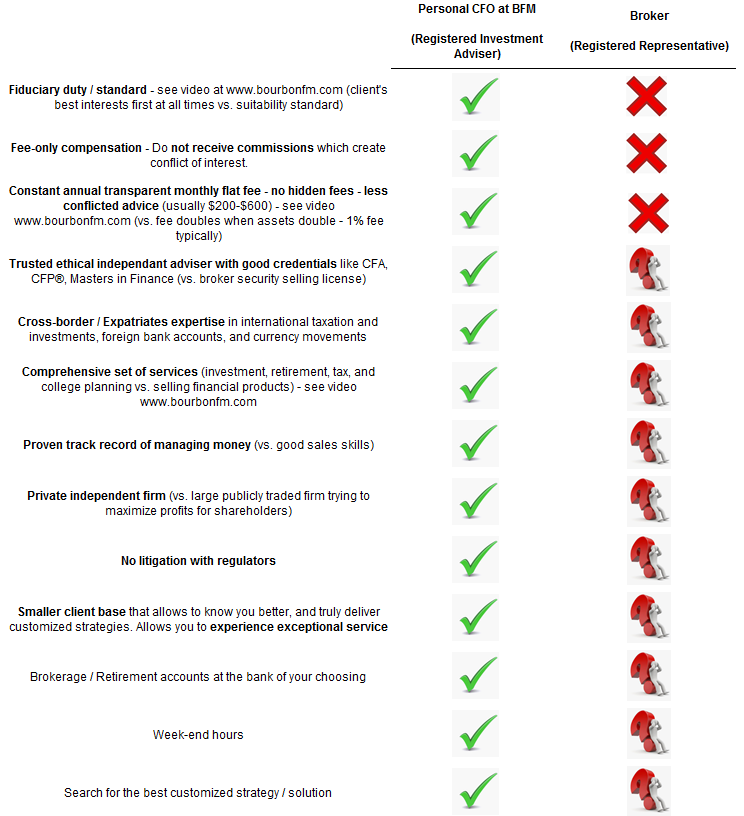

BFM acts in a fiduciary capacity with you to improve your financial life. As such, we place your interests ahead of our own, at all times, without exception. Our incentives are aligned with our clients. Compensation comes from only one source: you, our client.

BFM gives you professional help to improve your individualized investment decisions with tailored long-term proven strategies.

“People make better decisions with financial advisers” Dr. Shiller, 2013 Nobel Memorial Prize in Economic Sciences

COMMITMENT TO SERVICE

Do you know how many clients your advisor has? According to the McKinsey Global Wealth Management Survey (see here), the average number of clients handled per advisor was 184!

BFM's commitment is to have a smaller client base that allows us to know you better and truly deliver customized strategies for you. When you work with us, you will be part of a small and special group of less than 60 clients who receive all our attention. Our low client-to-advisor ratio speaks to our ability to cultivate the long-term relationships that are the key to our success. Being part of this small community of clients allows you to experience exceptional service by giving less-conflicted advice.

BFM SPECIALIZES ON EXPATRIATES and INTERNATIONALLY MOBILE PEOPLE

Financial planning and investing for expatriates is very frustrating and complex (FATCA, FBAR, PFIC…) due to restrictions, tax reporting, high taxation, and currency management so it is difficult to implement customized and sophisticated investment strategies that will help you reach your goals.

BFM helps clients that are U.S. expatriates family, U.S. persons married to a non-U.S. citizen spouse, non-U.S. persons investing in the U.S., and European expatriates who live in the U.S. who may invest in U.S. situs or non U.S. situs assets.

BFM international expertise is on:

- How to better coordinate and optimize your wealth and retirement assets in your home country abroad with the wealth you're building in the U.S. (currency and tax exposures).

- How to be compliant with U.S. tax laws, including FATCA, FBAR and PFIC rules.

Our founder Patrick is a French expatriate living in the U.S. since 1999 so he is very familiar with these complexities and solutions. He could explain to you why a U.S. citizen spouse may invest more in certain asset classes while a non U.S. citizen spouse may invest in other areas.

The BFM team has cross-border legal, tax, and financial planning expertise and can offer you a tailored financial plan with customized investment strategies that is harmonious with the multi-jurisdictional taxation regimes that you may face.

VISION

Our priorities are in line with our mission to partner with you to achieve your unique investment objectives. We are committed to provide you with customized global strategies that we also invest in. We believe our interests are very much aligned with your interests. BFM is proud of the reputation we have developed for investment excellence and serving clients well. We believe our success is driven by our investment and client focused culture. BFM believes in delivering a tailored client service model to meet your needs. We are passionate investors. We take seriously the responsibility our clients place in us to provide portfolio strategies that meet their specific needs.

“A good plan implemented today is better than a perfect plan implemented tomorrow.” - George Patton